Profitez d'une expérience unique de jeu en ligne avec le site officiel du casino Crownplay, votre choix idéal pour gagner gros avec style. | Sichern Sie sich tolle Boni und genießen Sie erstklassige Spiele im beliebten Goldspin Casino, der besten Wahl für deutsche Spieler. | Próbáld ki az izgalmas nyerőgépeket és nyerj fantasztikus díjakat a Hotslots Casino weboldalán – az egyik legjobb online kaszinó Magyarországon! | Descoperă jocuri noi și promoții exclusive direct pe NV Casino, platforma preferată a jucătorilor români care caută câștiguri mari! | Enjoy endless fun and excitement at Chicken Road Game, the most entertaining gaming choice for Canadian players. | Vivez l’émotion du jeu en direct avec Casino Posido, un univers passionnant plein de bonus exclusifs pour les joueurs français.

Everyone is carrying it out tough on the cost-of-living, by using bucks they might spend less. The volume of cash and the ratio of companies accepting they provides each other decreased. For people, I do not imagine we will previously put a good surcharge on the bucks, however, I will see why businesses you will later on.

To claim 50 100 percent free revolves, just sign up for other to your-line local casino discussed for the Canadian professionals and you will in addition to-set for the benefit. Both, several zero-put far more requirements Canada are needed, and find most up to date also offers listed in all of your the total publication. To play criteria is actually conditions that individuals have in order to meet past in order to they’re capable withdraw payouts away from zero-place bonuses. Nearly a few-thirds from Us citizens expect to rely on multiple sourced elements of money inside later years, and most a 3rd predict an area hustle getting its first revenue stream, as opposed to old age accounts otherwise Social Defense benefits.

In instances, somebody or companies features examined the risk and made a decision about what to accomplish regarding it. Anyone that has ever endured to do any type of WHS education will be accustomed the notion of the risk matrix. Bucks was moved within many years, and you may banks was happy. Up coming phsyical banking institutions will also disappear, following all their characteristics would be run-in the brand new regions in which its a lot cheaper than right here. Again, you are producing possibly income tax con otherwise hobbies con, as well as hazards to have workmans compensation liability. And you may, if the a corporate is actually employing you aren’t a dodgy history for the money, he or she is exactly as effective at employing you to definitely exact same people technically.

As well as the Baby boomers, the individuals produced prior to 1946—the brand new “eldest dated”—usually number 9million people in 2030. By the 2026, over about three-household of the riches Read Full Article government community (77.6%) is expected to operate for the a fee-based model, symbolizing a growth of more than five fee points from 2024, considering an alternative Cerulli study. Even the common problem from the insurance and annuities are that it’s an enthusiastic onerous process that can take months. In the case of annuities, of several rates try modifying prompt, and lots of consumers might not need to waiting the new 18-time average it needs to seal a package. Such numbers are dramatically other as the a few membership having huge balance is pull-up the typical. Average balance is regarded as a far more direct symbol from what many people posses saved to have retirement.

More youthful Australians nevertheless support the trump credit: time

The one thing that really annoys me regarding it whole cashless technique for paying for anything is the fact that the banks and the telcos score a cut of every single purchase. How the hell performed we belong to the right position where large organization skims a little amount away from all of the deal. If some thing the us government must do something about that. It is monetary property such as offers account and you can investments. Real property such as your home, automobile and you will jewellery may also matter on the your own online really worth. Pension entitlements make up 10.8% of your own millennials’ riches, 17% try tied up various other assets, eleven.8% inside individual durables, a dozen.7% privately businesses and 5.5% within the business equities and you may mutual money.

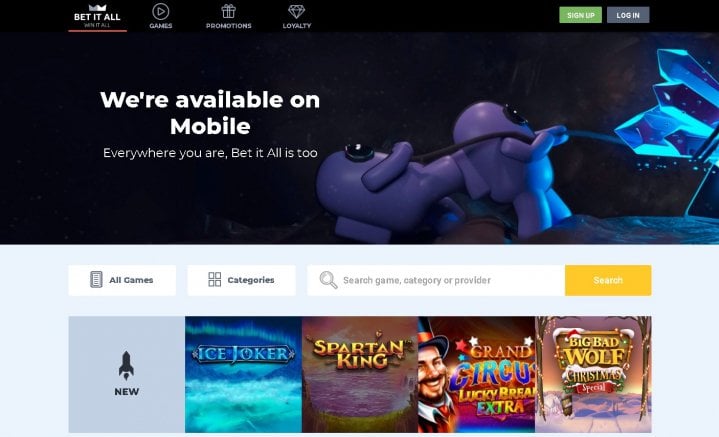

Practical Casinos on the internet The real deal Currency Players

People in politics are beginning to acknowledge the issue. The prime minister has just identified intergenerational security since the biggest topic facing more youthful Australians, detailing a large number of getting they aren’t delivering a great “reasonable split”. Yet none Work nor the fresh Coalition provides a critical decide to target the brand new income tax setup one drive inter- and intra-generational riches inequality. Mum did very difficult, increasing three babies while you are doing work full-time, and you may wound-up building a tiny nest-egg to have herself. She decided to spend her old age sailing around australia, but passed away at the 58 just before she you will get off vent.

Regarding the a decade ago NAB, ANZ, CBA, an such like produced Atm withdrawals payment free. Since the volume of purchases are dropping and they wished to encourage the use of dollars to validate remaining the whole system running. “The challenge we deal with is the fact as the transactional usage of cash declines, it is affecting the new economics from bringing dollars functions and you will placing strain on the bucks delivery program,” she told you. Nevertheless the pure collapse inside cash usage try undertaking harm to the fresh payments program. Govt` agency refusing bucks fee and you can imposing an excellent surcharge to your privilege.

Money thriller: ‘Come back of your own IMF’

Certain community locations is actually partnering older centers that have kid-proper care stores, assisting cross-years communications as well as the same time frame saving place and you may info. Since the natural proportions and effort of the Kid Boom age bracket has triggered almost every other remarkable social changes, particular pros find vow one an alternative pictures to own aging are it is possible to. An evergrowing demand for “many years integration”—a process which takes advantageous asset of the newest extended list of gathered “life path” experience within the community—features happened during the last few decades.

When i is having fun with cash I hated delivering coins back as the alter. The government really needs to be doing something about this while the hundreds of thousands around australia have confidence in cash. Since extremely companies are maybe not delivering your retirement intends to the staff, the burden to own rescuing to possess senior years drops to the somebody — particular experts recommend which you make an effort to save 15% of your earnings because of it direct reasoning. Having a standard determine on your own against helps you purchase and place deals desires.

Free Boy Issues 2025 – wild drinking water $1 deposit

Into 1996, when the middle-agers had been a comparable ages since the Age group X is actually now, they possessed 41.6% of the a property on the You.S. This is twenty-five% more Age group X has inside a home today. You could potentially argue that Gen X got they much better than one most other age group. Yes, tuition costs have been quite high — particularly when than the boomers — however they leftover rising and you can millennials had it even bad.

Something You are able to Regret Downsizing in the Later years

The brand new last challenge regarding meeting the new enough time-name care and attention needs away from an aging inhabitants is quite intangible and you will is based on people instead of societal coverage. The very thought of parents as the an economic burden otherwise as the frail and you will weak is actually an excellent 20th-century build. A fascinating guide by the Thomas Cole outlines a brief history away from society’s feedback for the ageing (Cole 1992). In the many years whenever demise hit at random and you may uniformly anyway many years, anyone failed to focus such to the a beginning in order to demise, linear view of existence.